2026 Budget

We are back! Nah - we are not referring to the fact that “we are back with our analysis” for the Budget.

Rather, we are back to saying what we say always - there were very few Tax changes (from our coverage perspective that is!), but many structural, forward looking announcements. Looks like the previous budget was an outlier, where we had a mix of both - tax changes as well as structural ones. It is back to structural ones only, this time.

Our coverage, as always, is usually mainly direct taxes, that too, the ones impacting individuals or small businesses, apart from covering some structural announcements and a bit of the key indirect taxes ones.

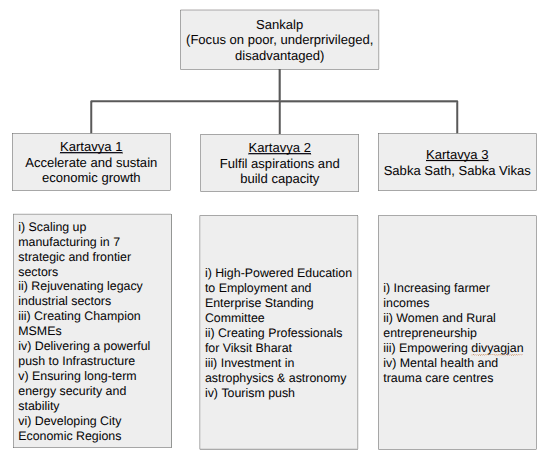

With this, let's try to decode the announcements made in this Yuva Shakti-driven Budget, as termed by the government, followed by our view of the Budget, at the end.

(By the way, barring a couple of summary statements for “less important” topics, this is not AI generated. Honestly, we did give it a try, but, eventually AI is AI. It clearly lacked the hold over the subject - it did not meet our standards!)

Key Highlights:

Let’s look at these in bit more detail:

Kartavya 1

i) Scaling up manufacturing in 7 strategic and frontier sectors:

Biopharma SHAKTI (Strategy for Healthcare Advancement through Knowledge, Technology and Innovation): INR 10k crore allocation to make India a Biopharma manufacturing hub. It will include a Biopharma-focused network with 3 new National Institutes of Pharmaceutical Education and Research (NIPER) and upgrading 7 existing ones. It will also create a network of over 1000 accredited India Clinical Trials sites.

India Semiconductor Mission (ISM): Expanding on ISM 1.0, the ISM 2.0 will produce equipment and materials, design fullstack Indian IP and strengthen the supply chains.

Electronics Components Manufacturing Scheme: The initial outlay of ~ INR 23k crore is now nearly doubled to INR 40k crore.

Rare Earth Corridors: To promote mining, processing, research and manufacturing in mineral rich states, to enable the Rare Earth Permanent Magnet scheme.

Establishing 3 dedicated Chemical Parks: This will enhance domestic chemical production and reduce import dependency.

Strong capital goods capability (Establishing hi-tech tool rooms, a scheme for enhancement of Construction and Infrastructure Equipment, Container Manufacturing Scheme).

Programme for textile sector (and integrated scheme of 5 sub-parts).

ii) Rejuvenating legacy industrial sectors - revive 200 clusters to improve their cost competitiveness and efficiency through infrastructure and technology upgradation.

iii) Creating Champion MSMEs:

Equity Support : INR 10k crore SME growth fund introduced, as well as topup of Self-Reliant India Fund with INR 2k crore (setup in 2021).

Liquidity Support : TReDS Platform has already benefited MSMEs in terms of liquidity. It is proposed to utilise the platform even more, when it comes to sourcing by Public Sector Enterprises directly or via GeM (Government e Marketplace), from MSMEs.

(The Trade Receivables Electronic Discounting System (TReDS) is an RBI-regulated digital platform enabling MSMEs to auction their trade receivables (invoices) to financiers for instant liquidity)

Professional Support : Para professionals - Corporate Mitra - will be trained by ICAI, ICSI, ICMAI, to help MSMEs with various compliance requirements at more affordable costs.

iv) Delivering a powerful push to Infrastructure:

Focus on developing infrastructure in cities with over 5 lakh population,

Capex for FY 2026-27 increased from 11.2 Lakh crore to 12.2 Lakh crore

This was not covered in the speech, however, it is noteworthy to mention that the Defence budget stands at 5.94 lakh crore (up from 4.91 lakh crore in previous budget).

Accelerate recycling of significant real estate assets of CPSEs through the setting up of dedicated REITs.

Seaplane VGF Scheme - to enhance last mile and remote connectivity and promote tourism.

v) Ensuring long-term energy security and stability - Carbon Capture Utilization and Storage

vi) Developing City Economic Regions:

City Economic Regions to be developed with an average annual allocation of INR 1,000 crore for 5 years per CER.

High-Speed Rail corridors between cities will be developed on 7 routes (Examples: Mumbai-Pune, Pune-Hyderabad, Varanasi-Siliguri)

High Level Committee on Banking for Viksit Bharat to comprehensively review the sector and align it with India’s next phase of growth.

Restructure the Power Finance Corporation and Rural Electrification Corporation.

Foreign Individuals will also be able to invest in Indian listed companies more easily.

Kartavya 2

i) High-Powered Education to Employment and Enterprise Standing Committee - with an aim to hit 10% global share in services by 2047.

ii) Creating Professionals for Viksit Bharat

Targeted investments aim to generate skilled employment across high-growth services.

Expansion of Allied Health Professional institutions and a national caregiving ecosystem.

Development of Medical Value Tourism Hubs combining healthcare, education, and research.

Strengthening AYUSH education, research, and global certification.

Orange economy - Scaling the AVGC (Animation, VFX, Gaming, Comics) ecosystem in schools and colleges.

University townships near industrial corridors.

Girls’ hostels in every district for STEM institutions.

iii) Investment in astrophysics & astronomy: 4 Telescope Infrastructure facilities will be set up or upgraded

The National Large Solar Telescope

The National Large Optical-infrared Telescope

The Himalayan Chandra Telescope

The COSMOS-2 Planetarium.

iv) Tourism

Various new design, hospitality, sports, and tourism institutions to be set up. Example - National Institute of Hospitality will upskill 10,000 guides in 20 iconic tourist sites.

National Destination Digital Knowledge Grid: This will digitally document all places of significance - cultural, spiritual and heritage. This initiative will create a new ecosystem of jobs for local researchers, historians, content creators and technology partners.

For the trekking enthusiasts - to offer world-class trekking and hiking experience - the government will develop Mountain trails, Turtle trails, Bird watching trails in the respective states.

Kartavya 3

i) Increasing farmer incomes through diversification, value addition, and technology adoption:

Some key diversifications include - Fisheries, animal husbandry, and high-value crops.

Dedicated programmes for coconut, cashew, cocoa, sandalwood, and nut cultivation.

Bharat-VISTAAR (Virtually Integrated System to Access Agricultural Resources), an AI-powered agri-advisory platform integrating AgriStack and ICAR data.

ii) Inclusive entrepreneurship

Building on the Lakhpati Didi initiative - (Self-Help Entrepreneur) SHE-Marts as community-owned retail outlets for women-led enterprises will be promoted.

Empowering Divyangjan : Expanded access to assistive technologies through ALIMCO (Artificial Limbs Manufacturing Corporation of India) and assistive device marts.

New and upgraded mental health and trauma care institutions, including NIMHANS-2.

Economic performance

Debt to GDP ratio for FY 2026-27 is estimated to be 55.6% of GDP, with an aim to keep it around 50% by FY 2030-31.

The fiscal deficit for FY 2025-26 is 4.4% of GDP (against the estimate given of 4.4% during the previous budget). This is in line with the broader goal defined in 2021-22, to bring it below 4.5%.

The fiscal deficit for FY 2026-27 is estimated to be 4.3% of GDP.

Direct tax changes

Capital markets

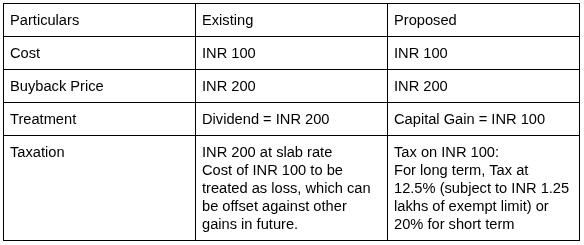

Buyback taxation:

Taxation of buybacks, is now rationalised for small investors. We shall not go into more details, but, effectively this is the change for small investors :

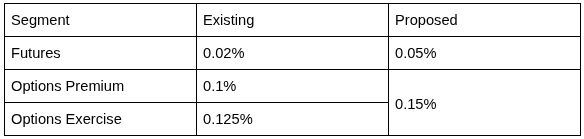

STT changes (on Futures and Options only, that is, derivatives segment):

As covered in the press conference later on the Budget day, this has been done to dissuade speculation from small participants, in the derivatives segment, as most retailers end up making substantial losses here.

Sovereign Gold Bonds (SGB):

Till now, the capital gains on redemption of SGB was fully exempt (on maturity), irrespective of its mode of acquisition.

Starting 1 April 2026, such gains will become taxable, if the SGB was not subscribed to by the assessee at the time of primary issuance by RBI. So for example, if you bought any quantity of any series of SGB, from the secondary market, then, at the time of its maturity, the capital gains will be taxable.

It remains to be seen, as to what happens, if the premature redemption option given by RBI, is exercised prior to 1 April 2026, for such bonds, obtained other than through a primary issuance.

Rationalisation of TDS and TCS

Various Taxes collected at source rates for foreign travel as well as for money sent outside India (foreign remittances), are reduced to 2% (TCS, which effectively, is used by taxpayers as tax credit, to offset against their total Income tax liability for a year).

Certificates for lower or nil TDS can be obtained by small taxpayers more easily now. Instead of filing an application with the Assessing Officer, now, this will be enabled via a rule based automated system.

Investors holding securities in various companies are currently required to submit such applications in form 15G / 15H, to all those companies separately, to avoid TDS. Going forward, such forms can be accepted by the Depository itself (NSDL / CDSL), which will share it with all the companies.

TDS on sale of immovable property will be deducted and deposited via Buyer's PAN only, instead of requiring any Temporary number (TAN).

Ease of compliance / reducing hassles

i) Timeline to revise a filed ITR is extended from 31 December to 31 March, upon payment of a nominal fee.

ii) ITR Filing due dates have been tweaked.

For individuals filing ITR 1 & 2 - No changes. Stays 31 July.

For businesses or trusts - Extended to 31 August, from 31 July (businesses must not be subject to Audit).

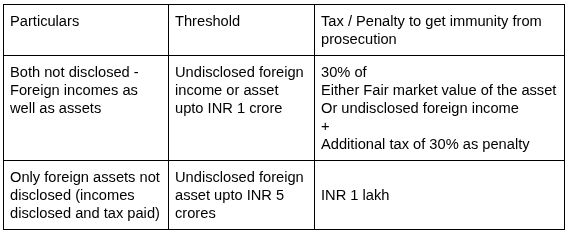

iii) Foreign Assets Small Taxpayers - disclosure scheme (for background - one may recall the NUDGE Campaign that we have been talking about, as recent as this post from December 2025 - Click to view the post)

This will be a 6 month window as below -

For non immovable foreign assets with total value less than INR 20 lakhs, the available immunity from penalties and prosecution is being made applicable retrospectively from 1 October 2024.

If it exceeds INR 20 lakhs:

iv) Updated Returns (for background - one may recall the #TaxDcodeWithAFI post we did on the topic in August 2025 - Click to view the post)

Updated ITR can be filed even if reassessment proceedings have begun as long as 10% tax over the applicable rate has been paid.

Updated ITR can be filed even in loss cases, as long as the reported loss is being reduced.

v) Safe harbour rules

This is nothing but the margin at which service is rendered to parent / related parties outside India, by IT service providers in India. The margin is at 15.5%. As long as this margin or any higher margin is applied by the provider, there would be lesser hassles of audits / litigations.

The definition of such service providers has been widened to include IT enabled services, Knowledge process outsourcing, Contract R&D services for software etc. The threshold for such services has been increased from INR 300 crore to 2,000 crore.

vi) Tax holiday (no income tax) till 2047, is provided to any foreign cloud services company, by using data centers in India. However, such services, if provided to Indian customers, then, it must be through an Indian reseller entity.

vii) Assessment and penal proceedings to be integrated.

Indirect tax changes

Key measures include:

i) Customs duty rationalisation to encourage domestic value addition in electronics, chemicals, and strategic manufacturing sectors.

ii) Reduction of inverted duty structures to improve competitiveness of Indian manufacturers.

iii) Targeted duty exemptions on inputs critical to sunrise and green industries.

iv) Simplification of customs procedures under a trust-based compliance framework.

v) Continued GST system stabilisation through improved return filing, analytics-based enforcement, and faster refunds for exporters.

These measures are intended at reducing friction in trade, input costs, as also strengthening India’s integration into global value chains.

Our view

We know that there was a lot of build up prior to the Budget day. But, our readers would know, that all those usually are rumours or at best, pressure tactics by vested interest groups prior to the budget. Else those hold no significance. If at all, something turns out to be right, that's at best, a coincidence.

So, keeping those emotions aside, here is our view -

The announcements that we have highlighted as a part of the 3 Kartavya, are big ones. As hinted to, in the Economic Survey too, the focus clearly looks to be on making India an innovations hub, by tapping the knowledge potential in deep science and technology. Pharma, defence, aerospace, astronomy, software, electronics, AI - you name it.

We are saying this out of our experience with the “hit rate” of the past budgets. Railways, defence, manufacturing etc - the initial phases of these - which used to be the themes, say in 2019 / 20 etc, are visible on ground today. That builds a stronger case, that what we have seen in previous or current budgets, might bear great results on similar time frames - though - only time will tell.

Even though, going by the popular notion that “there is no tax cut”, there are various important changes related to direct taxes, like simplifying TDS / TCS, giving relief to small investors on buyback taxation, or even the facility to avoid litigation related to undisclosed foreign assets or incomes.

Only thing where we think they could have been better is with the hike in STT. Not because of any emotional / sentimental factors. Not even because “the markets fell a lot”. Yes, this may be debated, but we do think that there are better ways to deal with the issue that they are trying to tackle.

At a time when we are looking to become one of the top 3 economies in GDP terms, it is important that capital markets are as liquid as possible. Every participant in these markets just improves this liquidity and depth. These things make it sound like “running after a few hundreds of rupees, when you are dealing in lakhs of crores”.

And, high chances, that it may not end up dissuading the participants, as it is still a fraction of the total values. In fact, this itself is a counterpoint, that, if they are anyways not going to be dissuaded, then, it improves the revenues of the government.

Additionally, the retrospective change in the taxation of SGBs - may appear small, but it starts creating an environment of mistrust, wherein, some tax benefit given at some point in time, can be suddenly snatched away, by giving various reasons. We hope that the think tank would take such feedback from professionals in this field and would take steps to restore the trust.

So in summary, it may sound as a boring budget, but boring at times, is what is needed. Especially if boring means so many futuristic announcements.

And to be fair, apart from the major cuts on direct taxes, we had the GST 2.0, which had significant rate rationalisations, with the majority of it, being a reduction, means that the government has already forgone some of their incomes in the shorter term, while the outgoes still remain. As a responsible economy, we cannot afford to go overboard on debt, in order to cut taxes or expand on expenses. That would be deviating from fiscal discipline.

Accordingly, barring a couple of minor blips - more noteworthy being the “sentimental aspect” of STT, that too, for 1 section of stakeholders (which can surely be debated as well), it is a really promising roadmap of the times to come and the progress that we can make.

Note - there are many more aspects in the speech that we have skipped, in order to keep it relevant for our primary audience.

For any queries/feedback/suggestions, feel free to reach out to us at help@ayanshfinsights.com, or drop us a message/chat/call on our number: +91 93220 27741.

If you wish to avail any of our services, you can view Our Offerings.

Footnotes:

Link to Budget Speech, Finance bill, Memorandum